Macro Mondays supplied by out good freinds at Simplicity Consultancy.

US Macro - 28th October 2022

Market sentiment was positive last week following hopes the FED might slow the pace of hikes. Canada's unexpected decision to hike interest rates by 50bp instead of 75bp instigated this sentiment. Aggressive rate hikes from the FED have led to the dollar rising steeply and destabilisation of global markets offering further hope to the markets that FED hikes might slow down.

The economy continued to give mixed signals on how much room the FED has to continue with aggressive hiking following US manufacturing activity dropping into contraction territory for the first time since June 2020. Meanwhile, GDP predictions for Q3 were released by the Commerce Department estimating GDP growth of around 2.6%, beating consensus by 0.2%.

This would be the first positive quarter of the year and appears to have silenced recession fears (at least in the short term). Consumer spending and business investment helped negate the impacts of reduced retail investment. Pending home sales experienced a drop in September of 10.2%, the sharpest monthly drop since the beginning of the pandemic.

FED hikes have clearly affected retail investment, however, as long as GDP continues to grow due to business investment and consumer spending, the FED has room to continue to hike interest rates further.

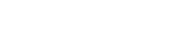

Whilst consumer spending remained high it is important to note consumer savings continued to decrease rapidly and credit card debt continued to increase (Pic. 1). The $6.7 trillion printed over the past 30 months is still flowing through retail investors; until the consumer capital runs dry consumer spending will not decrease allowing the FED to continue interest rate hikes preventing a macro-bottom.

The economy continued to give mixed signals on how much room the FED has to continue with aggressive hiking following US manufacturing activity dropping into contraction territory for the first time since June 2020. Meanwhile, GDP predictions for Q3 were released by the Commerce Department estimating GDP growth of around 2.6%, beating consensus by 0.2%.

This would be the first positive quarter of the year and appears to have silenced recession fears (at least in the short term). Consumer spending and business investment helped negate the impacts of reduced retail investment. Pending home sales experienced a drop in September of 10.2%, the sharpest monthly drop since the beginning of the pandemic.

FED hikes have clearly affected retail investment, however, as long as GDP continues to grow due to business investment and consumer spending, the FED has room to continue to hike interest rates further.

Whilst consumer spending remained high it is important to note consumer savings continued to decrease rapidly and credit card debt continued to increase (Pic. 1). The $6.7 trillion printed over the past 30 months is still flowing through retail investors; until the consumer capital runs dry consumer spending will not decrease allowing the FED to continue interest rate hikes preventing a macro-bottom.

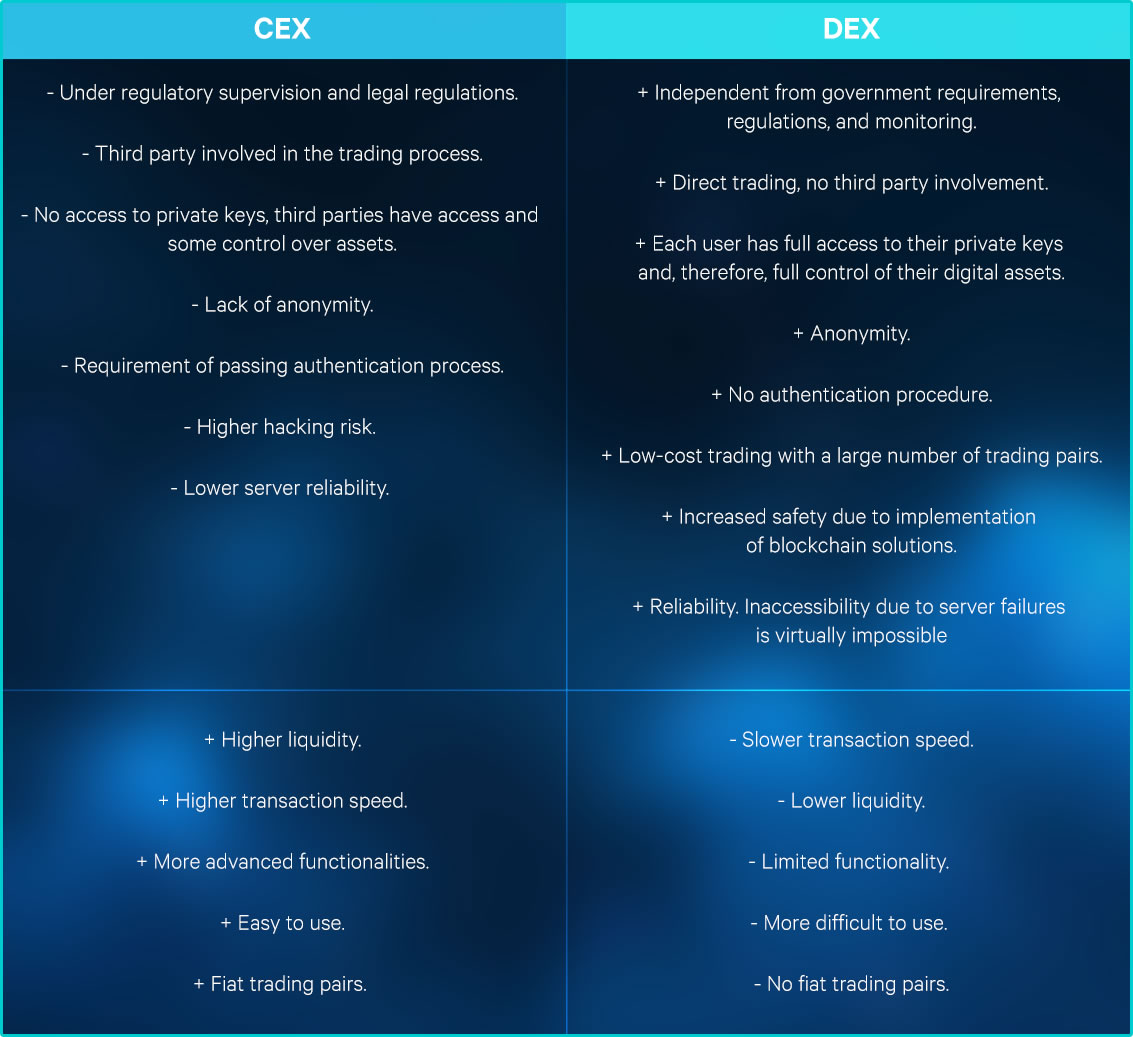

DEX: Decentralized Exchange

The greatest drawbacks of CEX, including third-party interference, a lack of transparency, inadequate security, and a lack of anonymity, can be addressed by decentralized exchanges.

A DEX functions as a decentralized application (dApp) on a blockchain rather than being based on internal servers and its own IT infrastructure.

This makes it possible for the decentralized exchange to be free from oversight or supervision by outside parties (such authorities or financial regulators).

Assets are never controlled or in the possession of a third party during a transaction on DEX because it is a non-custodial exchange. Instead, smart contracts—self-executing programs that operate on blockchain networks—are used to control the trade of assets.

This implies that a middleman never comes into contact with the underlying asset.

The adoption of distributed ledger technology solutions by DEX enables it to improve the transactional and asset management transparency. Users have full control over their assets and have access to their private keys.

Blockchain dramatically lowers the danger of piracy and hacking assaults while enhancing security.

Decentralized exchanges, in contrast to CEX, allow users to remain anonymous. There is no requirement to complete KYC, provide personal documents online, or comply with AML regulations.

Unfortunately, using decentralized exchanges might be more difficult, especially for those who are unfamiliar with the De-Fi environment. The layout is less user-friendly, so new traders may need some time to get used to it.

There are fewer trading features because the decentralized exchanges are still under development (such as limit orders, margin trades, or stop losses).

However, the decentralized exchanges are attempting to adapt the features customers are familiar with from CEX, so perhaps it will only be a matter of time before users can access them.

Uniswap, Bisq, GDEX, Binance DEX, and, in the future, Tecra DEX are some examples of DEX.

A DEX functions as a decentralized application (dApp) on a blockchain rather than being based on internal servers and its own IT infrastructure.

This makes it possible for the decentralized exchange to be free from oversight or supervision by outside parties (such authorities or financial regulators).

Assets are never controlled or in the possession of a third party during a transaction on DEX because it is a non-custodial exchange. Instead, smart contracts—self-executing programs that operate on blockchain networks—are used to control the trade of assets.

This implies that a middleman never comes into contact with the underlying asset.

The adoption of distributed ledger technology solutions by DEX enables it to improve the transactional and asset management transparency. Users have full control over their assets and have access to their private keys.

Blockchain dramatically lowers the danger of piracy and hacking assaults while enhancing security.

Decentralized exchanges, in contrast to CEX, allow users to remain anonymous. There is no requirement to complete KYC, provide personal documents online, or comply with AML regulations.

Unfortunately, using decentralized exchanges might be more difficult, especially for those who are unfamiliar with the De-Fi environment. The layout is less user-friendly, so new traders may need some time to get used to it.

There are fewer trading features because the decentralized exchanges are still under development (such as limit orders, margin trades, or stop losses).

However, the decentralized exchanges are attempting to adapt the features customers are familiar with from CEX, so perhaps it will only be a matter of time before users can access them.

Uniswap, Bisq, GDEX, Binance DEX, and, in the future, Tecra DEX are some examples of DEX.