New solutions are constantly developed as technology advances.Decentralised exchanges have the promise of a new future and opportunity for traders everywhere, and DeFi are transforming the global market.

CEX, or Centralized Exchanges

The most common operating model for cryptocurrency exchanges at the moment is CEXs. Let's get started by learning how they operate and what makes them such a great option for users of digital currencies.

A traditional stock exchange and a centralized exchange are similar in many aspects. But instead of stocks, it deals in cryptocurrency assets.

In order to promote trade between users, a CEX often uses order books. Every buy and sell order that a trader makes is recorded in the order book; each order specifies the quantity of currency to be bought or sold as well as the Price (US$).

The relevant buy and sell orders are then matched, allowing for their execution.

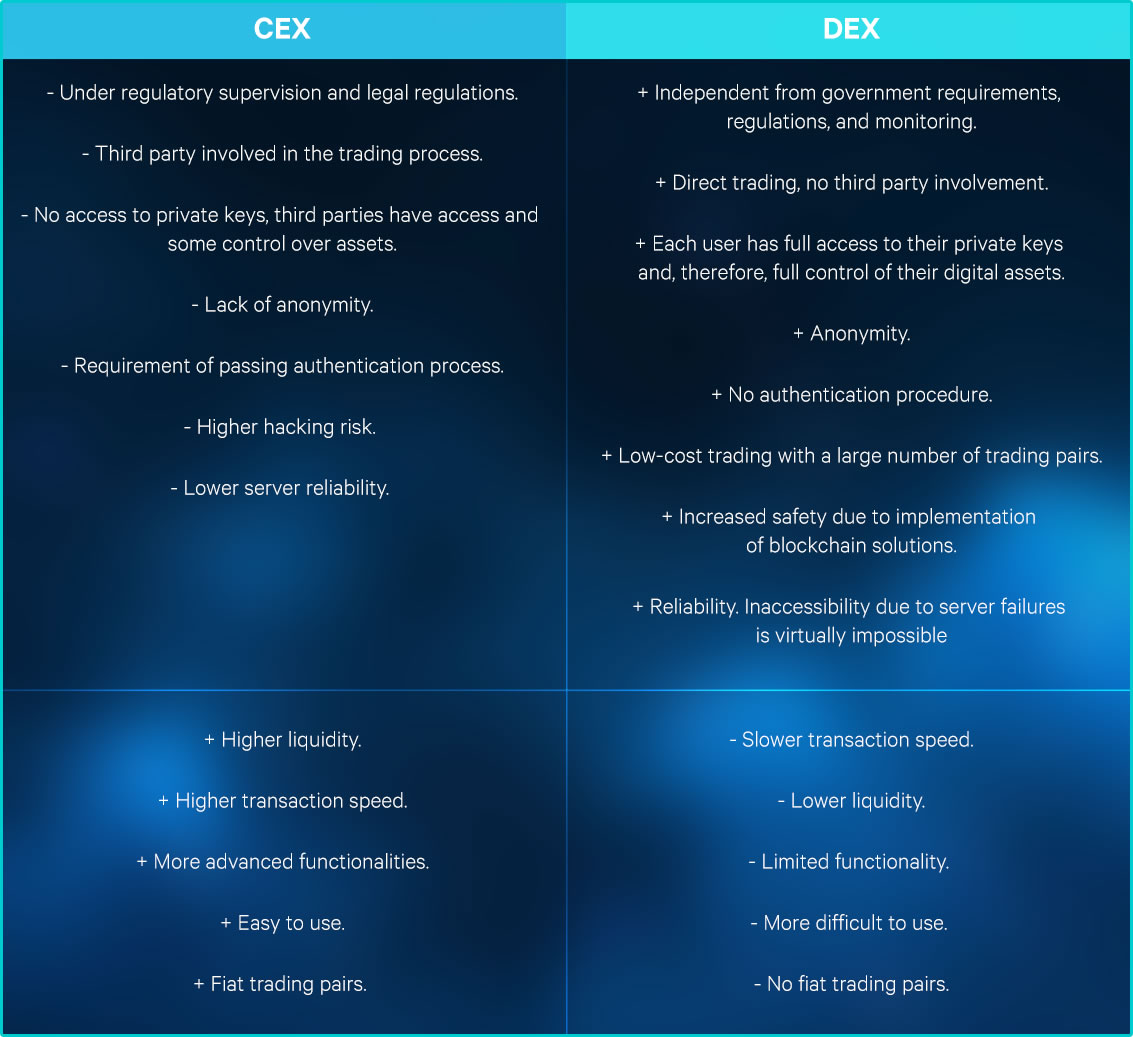

The inclusion of third parties is one of the most significant differences between CEX and DEX. A private, for-profit business manages CEX.

Customers do not have complete control over their assets or access to their private keys on centralized exchanges like CEX, which results in a lack of transparency on CEX's part. Internal data sharing on CEX occurs across dedicated servers and is subject to centralized security procedures. Hacking attacks are more likely to occur in centralized exchanges.

Because centralized exchanges are subject to regulatory oversight, they frequently already have authorisation processes in place, such as the need to comply with KYC (know-your-customer) requirements or anti-money laundering (AML) systems.

Higher trading volume (since they have been operating longer and have accumulated a larger number of traders), faster trading speeds, and more intuitive interface are some of CEX's greatest advantages to DEX.

Centralized exchanges are normally the novices' first choice for trading and managing their digital currencies because they are generally simpler and relatively convenient to use.

There is a huge variety of trading pairs available on centralized exchanges. This also applies to fiat trading pairings, meaning you can buy cryptocurrencies using fiat money. Fiat currency deposits and withdrawals are also feasible.

Centralized exchanges include Binance, Kraken, OKEx, Huobi, and Coinbase, as examples.

A traditional stock exchange and a centralized exchange are similar in many aspects. But instead of stocks, it deals in cryptocurrency assets.

In order to promote trade between users, a CEX often uses order books. Every buy and sell order that a trader makes is recorded in the order book; each order specifies the quantity of currency to be bought or sold as well as the Price (US$).

The relevant buy and sell orders are then matched, allowing for their execution.

The inclusion of third parties is one of the most significant differences between CEX and DEX. A private, for-profit business manages CEX.

Customers do not have complete control over their assets or access to their private keys on centralized exchanges like CEX, which results in a lack of transparency on CEX's part. Internal data sharing on CEX occurs across dedicated servers and is subject to centralized security procedures. Hacking attacks are more likely to occur in centralized exchanges.

Because centralized exchanges are subject to regulatory oversight, they frequently already have authorisation processes in place, such as the need to comply with KYC (know-your-customer) requirements or anti-money laundering (AML) systems.

Higher trading volume (since they have been operating longer and have accumulated a larger number of traders), faster trading speeds, and more intuitive interface are some of CEX's greatest advantages to DEX.

Centralized exchanges are normally the novices' first choice for trading and managing their digital currencies because they are generally simpler and relatively convenient to use.

There is a huge variety of trading pairs available on centralized exchanges. This also applies to fiat trading pairings, meaning you can buy cryptocurrencies using fiat money. Fiat currency deposits and withdrawals are also feasible.

Centralized exchanges include Binance, Kraken, OKEx, Huobi, and Coinbase, as examples.

DEX: Decentralized Exchange

The greatest drawbacks of CEX, including third-party interference, a lack of transparency, inadequate security, and a lack of anonymity, can be addressed by decentralized exchanges.

A DEX functions as a decentralized application (dApp) on a blockchain rather than being based on internal servers and its own IT infrastructure.

This makes it possible for the decentralized exchange to be free from oversight or supervision by outside parties (such authorities or financial regulators).

Assets are never controlled or in the possession of a third party during a transaction on DEX because it is a non-custodial exchange. Instead, smart contracts—self-executing programs that operate on blockchain networks—are used to control the trade of assets.

This implies that a middleman never comes into contact with the underlying asset.

The adoption of distributed ledger technology solutions by DEX enables it to improve the transactional and asset management transparency. Users have full control over their assets and have access to their private keys.

Blockchain dramatically lowers the danger of piracy and hacking assaults while enhancing security.

Decentralized exchanges, in contrast to CEX, allow users to remain anonymous. There is no requirement to complete KYC, provide personal documents online, or comply with AML regulations.

Unfortunately, using decentralized exchanges might be more difficult, especially for those who are unfamiliar with the De-Fi environment. The layout is less user-friendly, so new traders may need some time to get used to it.

There are fewer trading features because the decentralized exchanges are still under development (such as limit orders, margin trades, or stop losses).

However, the decentralized exchanges are attempting to adapt the features customers are familiar with from CEX, so perhaps it will only be a matter of time before users can access them.

Uniswap, Bisq, GDEX, Binance DEX, and, in the future, Tecra DEX are some examples of DEX.

A DEX functions as a decentralized application (dApp) on a blockchain rather than being based on internal servers and its own IT infrastructure.

This makes it possible for the decentralized exchange to be free from oversight or supervision by outside parties (such authorities or financial regulators).

Assets are never controlled or in the possession of a third party during a transaction on DEX because it is a non-custodial exchange. Instead, smart contracts—self-executing programs that operate on blockchain networks—are used to control the trade of assets.

This implies that a middleman never comes into contact with the underlying asset.

The adoption of distributed ledger technology solutions by DEX enables it to improve the transactional and asset management transparency. Users have full control over their assets and have access to their private keys.

Blockchain dramatically lowers the danger of piracy and hacking assaults while enhancing security.

Decentralized exchanges, in contrast to CEX, allow users to remain anonymous. There is no requirement to complete KYC, provide personal documents online, or comply with AML regulations.

Unfortunately, using decentralized exchanges might be more difficult, especially for those who are unfamiliar with the De-Fi environment. The layout is less user-friendly, so new traders may need some time to get used to it.

There are fewer trading features because the decentralized exchanges are still under development (such as limit orders, margin trades, or stop losses).

However, the decentralized exchanges are attempting to adapt the features customers are familiar with from CEX, so perhaps it will only be a matter of time before users can access them.

Uniswap, Bisq, GDEX, Binance DEX, and, in the future, Tecra DEX are some examples of DEX.